Introducing Blockframe

NFT Marketplace & More

Blockframe is available at https://blockframe.io

We are excited to introduce Blockframe - a marketplace for non-fungible tokens (NFTs). Blockframe features on-chain royalties, AI-assisted collection creation tools at scale, and an NFT perpetuals exchange, enabling users to interact with the NFT market in new formats. Our platform is based on three tenets:

Creators come first

We believe that giving creators the tools to create and protecting their intellectual property is critical to the growth of the NFT market.

An incentivized and engaged user base

We believe that platform users are critical to building a true powerhouse, and therefore, users must be incentivized to participate in the community.

Removing barriers to entry into the NFT market

We believe that in order for the NFT market to reach its potential, technical and financial barriers to entry need to be eliminated.

Blockframe is available on Ethereum and zkSync Era

Single-sign on and Blockframe Wallet

Users will be able to sign into Blockframe via Google, Twitter, Discord, phone, e-mail and more. Once signed in, Blockframe manages wallet creation, eliminating the technical barriers often associated with setting up cryptocurrency wallets to interact with the blockchain. Blockframe’s integrated in-house wallet not only simplifies the setup but also offers functionalities to buy, send, swap, and bridge cryptocurrencies, all within the same user interface.

Blockframe will never store your private key nor can Blockframe ever access your private key.

Marketplace

2% Blockframe fee on every NFT sale that will be transferred to a smart contract.

Trading Engine

Blockframe’s marketplace is powered by a customized version of Opensea’s Seaport, adapted to support native marketplace NFT royalty payments.

Sealed Bid Auctions

Blockframe introduces sealed bid auctions - offering a reliable system for NFT price discovery and a standardized on-chain NFT pricing mechanism. Sealed bid auction prices can be used in place of oracles to supply NFT on-chain pricing. This feature is made possible by Blockframe’s Bulk Semaphore protocol, the first solution to effectively address and achieve privacy at scale on Ethereum and Ethereum-like chains

To learn more:

Tweet: https://twitter.com/Blockframe_io/status/1676584218066051072

Demo: https://blockframe.io/sealed-bids-demo

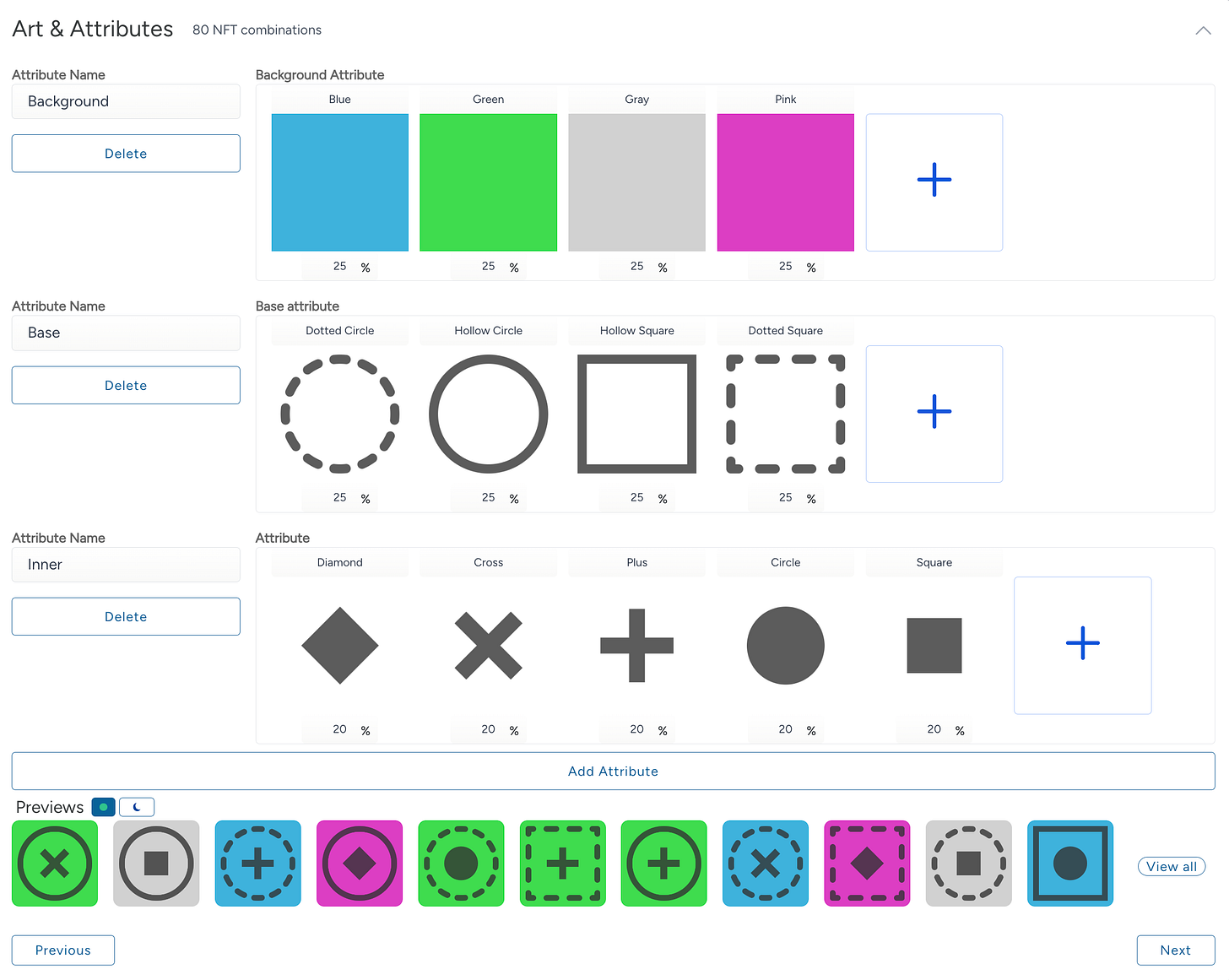

Creator Studio: NFTs for everyone

Blockframe users are able to create customizable, production-grade and user-owned NFT collections at scale in under 5 minutes with no special expertise required. Right from Blockframe’s in-house image editor and combiner:

Blockframe’s NFT collection contracts are gas-optimized with ERC721-A bulk mints.

Creators will have the option to create editable ERC-6551 NFT collections a.k.a. account bound NFTs.

Traits and Editable NFTs

For new collections

Remix owned traits to create new collections

Buy, sell, add and remove traits from NFTs you own with updates persisting across all NFT marketplaces

Launchpad

Collections created on Blockframe will be displayed immediately on our Launchpad and available for public mint and presale as per the creator’s defined schedule.

On-chain Royalty

Blockframe introduces on-chain royalties enabling users to buy, sell, and split future royalty proceeds for NFT collections. Our royalty protocol is generic and can be applied beyond NFTs; it could be adapted to manage music royalties on platforms like Spotify at scale today.

Collection owners are now able to claim royalty contracts for their collections. NFT collections without claimed royalties will default to a 0% royalty rate. For the top 200 NFT collections, we will automatically assign a royalty contract, especially since ownership for some associated smart contracts has been revoked.

Mechanics

Representation: For each collection, we use ERC-20 tokens to represent a user's stake in the royalty contract.

Royalty Tokens: A user's ownership percentage of royalty revenue is calculated by comparing their balance of the royalty token to the total supply of the royalty token. For example, if a user holds 10% of the total ERC-20 tokens for a collection's royalty, they own 10% of future royalty revenue for that collection.

Royalty Distribution: Creators can withdraw their share of the royalties based on the following formula. This formula determines how much of the total royalty pool they're entitled to, based on their percentage ownership of the royalty tokens and amount of royalties previously withdrawn.

Deposits: Anyone can deposit royalties for any royalty-bearing address at any given time for any arbitrary reason.

Interoperability: Other platforms can directly interact with Blockframe’s Royalty Service on the blockchain. This ensures that royalties can be managed and distributed across different platforms. Looking ahead, as NFT pricing becomes standardized, Blockframe aims to enforce royalties across various marketplaces for new collections created on our platform.

Blockframe Exchange

0.02% fees

Launching on zkSync Era Testnet and will not be available for users in the United States

Blockframe Exchange is a decentralized perpetuals exchange with the underlying as NFT collections. This allows traders to invest in NFTs at any price point, removing barriers to entry and allowing creators to monetize their work in a new format. Blockframe will also support perpetual indexes tracking multiple NFT perpetuals allowing traders to invest in multiple collections at once such as a “Blue Chip Index”

Blockframe Exchange is running a deployment of Perpetual Protocol v2 customized specifically for NFTs based on Paradigm Research’s Floor Perps design: https://www.paradigm.xyz/2021/08/floor-perps. Perpetual Protocol is a completely decentralized perpetuals exchange powered by automated market maker Uniswap and featuring block-based funding.

NFT-specific modifications:

Funding for NFT-backed shorts

NFT-backed shorts pay funding in the form of additional perpetuals minted to longs up until the liquidation criteria is hit.

Funding paid is added to the NFT-backed trader’s short position.

Liquidation criteria for NFT-backed shorts

NFT-backed shorts are underwater only if funding in kind forces their short position size to exceed the number of NFTs deposited as collateral.

Dynamic collateralization requirements

Whenever the system is undercapitalized, we will increase the collateral requirements (i.e. reduce the leverage granted) for new buyers in order to ensure adequate liquidity for sellers.

Methodology

Blockframe operates its own decentralized Chainlink oracles for NFT perpetual index prices, allowing approved external entities to input their own pricing data into the oracle.

However, our ultimate objective is to create an oracle-free decentralized NFT perpetuals exchange, leveraging standardized on-chain pricing via sealed bid auctions and other strategies. During the testnet phase, we will also be exploring these various pricing techniques and methodologies.